Best Online Credit Cards for this year 2024

January 25, 2024

The Best Online Credit Cards for 2024

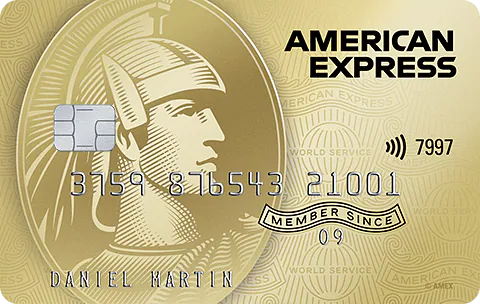

American Express Gold Elite Credit Card

In a nutshell:

Online credit cards have transformed the way Mexicans manage their transactions and access financial services. This evolution has led to growing popularity due to their convenience and flexibility, allowing transactions from the comfort of home, eliminating long lines and face-to-face visits to establishments.

In the dynamic financial landscape of 2024, it is crucial to be aware of the most prominent options. This roundup is based on last year's statistics, offering a clear view of the best online credit cards for this year.

These options have been carefully selected to meet a variety of financial needs, setting the course for a more efficient and accessible future in the world of online transactions:

NU Mexico: Agility and Control in Your Hands.

The NU Credit Card stands out for its 100% online processing, with no annuities or hidden fees. Accepted internationally through Mastercard Gold, it offers options of purchases in installments with fixed rates, Nu interest-free months in different platforms and credit limit adjustment. Its application allows total control, from expense analysis to a virtual card for secure online purchases.

American Express: Elegance and Security in Every Transaction

The Gold Elite Credit Card from American Express offers 100% digital processing, no annual fee for the first year and effective protection against theft and unrecognized charges. With benefits such as interest-free months, monthly bonuses and a complimentary drink at Starbucks, it combines luxury with security in every purchase.

Citibanamex: Simplicity and Financial Personalization

The Citibanamex Simplicity Credit Card offers easy and secure access through its app, with no annual fee for monthly use and the ability to set spending limits from the app. With cash withdrawal and the option to choose the annual cutoff date, simplify and personalize your financial experience.

INVEX: Flying High with Exclusive Benefits

The INVEX 0 Volaris Credit Card offers a free welcome flight, free annuity when used monthly and interest-free months on Volaris purchases. With bonuses in the Volaris wallet and discounts on in-flight meals, this card is designed for lovers of travel and air experiences.

Plata: Agility and Flexibility within your Reach

The Plata Card offers fast 24-hour delivery, credit limit of up to $200,000 MXN and real money cashback. With interest-free payment options and a MasterCard certificate to guarantee secure payments, it provides agility and flexibility for a variety of financial needs.

Vexi: No Fees, No Hassles

The Vexi American Express Credit Card stands out for its no annual fee for life and ease of obtaining with no proof of income required. With a #VexiCashback rewards program and interest-free month promotions, Vexi offers a hassle-free financial experience and consistent rewards.

Choose

Choosing the right online credit card is essential in the digital age. Credit cards offer various rewards and benefits, such as interest-free months, which are crucial for efficient financial management.

Nu Mexico: Innovation and Ease

The Nu Credit Card, with its low interest rate and cashback system, offers a unique online credit experience. Its app provides control and flexibility in your payments.

Vexi American Express: Prestige and Confidence

American Express is distinguished by its focus on quality services and superior protection. With exclusive benefits for travel and purchases, it is an excellent card option.

Citibanamex Simplicity: Simplicity and Transparency

The Citibanamex Simplicity Card prioritizes convenience and simplicity, with a competitive annuity and clear conditions. Ideal for those who value practicality in their spending.

INVEX Volaris: Modern Travelers

INVEX Volaris focuses on travel, offering discounts on tickets and access to airport lounges. It's a perfect card for those looking for rewards on their adventures.

Plata Card: Agility and Reach

The Plata Card stands out for its high credit line and flexible paymentoptions. With competitive interest rates, it is an ideal card for a wide range of financial needs.

Vexi American Express: Freedom and Rewards

Vexi offers a fee-free card, ideal for those looking for flexibility and control over their finances. Its cashback program is an added attraction.

Importance of Credit Cards in Everyday Life

Online credit cards are essential tools in our daily lives. They allow us to make purchases and manage expenses with convenience and security.

Choosing the Right Card

To select the best credit card, it is crucial to consider the requirements, interest rates, and benefits. Each card has its own particularities and should be aligned with your needs.

Application Process and Requirements

The online credit card application process is straightforward. However, it is important to review the requirements and conditions to avoid any mistakes or misunderstandings.

Maximize Your Benefits

When using your credit card, look to maximize benefits such as points, discounts at stores and hotels, and special promotions. Every purchase can add value.

Evaluating Available Options

Explore the online credit card options available, comparing interest rates, annuities, and fees. Accurate information is key to making a good choice.

Safety and Security

Transaction protection is a critical aspect. Look for cards that offer advanced security measures, such as fraud protection and app-based monitoring.

Travel and Leisure Benefits

For travel lovers, some cards offer benefits such as access to airport lounges, discounts on tickets, and redeemable points at hotels.

Smart Financial Management

The right credit card can help you manage your finances more efficiently, providing flexibility and control over your spending and balance. You can also see loans here.

Conclusion: Your Decision Matters

Choosing the right online credit card can make a big difference in your financial life. Consider all the options and select the one that best suits your needs and lifestyle.

Exclusive Mexico Comparisons and Benefits

Each of these cards shown in this platform is for you to get a better view of the comparisons in Mexico and choose the one that best suits you; each one of them is designed to cover different financial needs. Where you get exclusive benefits; which in this case combine practicality and technology; managing to transform the way you manage your finances. In this space you will have access to a wide selection of options and you will be able to compare the different features and benefits offered by the credit cards available in the market, so that you can make a more informed decision.

Credit.com.mx

At credito.com you get the perfect option to help you find the card that best suits your lifestyle at the beginning of the year; in this case we are referring to the best online credit card for 2024.

Juan Guerreo

Juan Guerreo loves eating ice cream and writing about finance